The corner shop has been the backbone of our communities for decades, and it’s continuing to thrive.

Morrisons recently announced plans to open 400 more of its Daily convenience stores, while earlier this year, Asda launched 110 new Express stores. Sainsbury’s and Marks & Spencer are also expanding their convenience offerings, though at a slower pace.

The unaffiliated independents (which make up 38% of all c-stores) also continue to maintain their foothold in local communities, seeing fewer closures than multiples and acting as a kind of “social glue”.

What, then, are the success rates of UK convenience stores?

Success rates of UK convenience stores

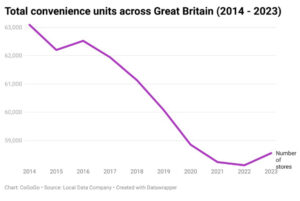

For decades, onlookers have been predicting the decline of convenience stores like Londis, as online shopping grew and major supermarkets opened smaller outlets like Tesco Express and Sainsbury’s Local. However, the sector has defied these expectations, with sales surging during the Covid-19 pandemic.

Indeed, the convenience sector has seen a marked increase in the number of retail units reaching their third-year anniversary, according to the Local Data Company.

Independent convenience retailers have experienced strong year-on-year growth in survival rates, dipping only slightly in 2021 with a growth rate of 61.6%. The rising trend of consumers shopping locally has been a key driver behind this success.

The Local Data Company also reports that over the past decade, independent convenience stores have seen fewer closures than multiples, with the exception of 2018. In 2021, independent stores achieved a net increase of 1,242 units, a notable rise driven by increased consumer demand for local shopping.

In contrast, multiples have experienced a narrowing gap between openings and closures since 2021, largely due to the expansion of supermarket chains and symbol group estates.

Factors determining success rates

The convenience store has been described as “like a cat with nine lives”, surviving (and even thriving) throughout the pandemic and the supply chain disruptions and inflation of 2022 – 2024.

Adapting a high-volume, low-margin strategy

Grocery retail notoriously survives on the thinnest of margins (often south of 3%, by some accounts), which means high volumes are key to staying afloat.

How do you achieve high volumes? “Value”, say some industry experts. As discounters such as Aldi and Lidl grow their market share, it is all the more important that symbols and independents offer budget ranges for more cash-strapped consumers – especially in areas with lower socio-demographic groupings.

The key? Carefully calibrated prices that remain competitive with other players, but that are also sufficient to sustain operations and grow.

Adapting to changing consumer preferences and regulatory changes

Meeting the growing demand for healthier options, such as protein shakes and low-calorie snacks, and offering premium and budget ranges for different socio-demographic groups.

As smoking rates decline and the tobacco market contracts, expanding the range of vape products and flavours could offer a new revenue stream. Indeed, in independents and symbols, the vape market is now worth £1.67bn. In anticipation of the disposable vape ban, c-stores should start stocking pod systems and hybrids.

Additionally, stocking items from growing categories such as RTD coffees and cold brews, and trendy TikTok-popular items and limited-edition flavours will help to drive footfall.

Offering value-added services

Offering services like lottery, bill payment, free-to-use cash machines, and parcel collection points can promote cross-selling by drawing more customers into the store for non-grocery needs. Once inside, customers are more likely to make additional purchases, such as snacks, drinks, or household essentials, while they complete their primary task.

Home grocery delivery (currently offered by 34% of c-stores) is also a way to reach customers that may located outside a reasonable walking distance.

Filling a niche

You might think that convenience stores all follow the same model, but there’s actually a surprising amount of variety behind those similar-looking fascias.

Mark McCall, owner of McCall’s Organics in Manchester, told the Guardian that his point of differentiation has been “variety and quality”. He believes that this has catered to the growing trend of young people buying food to eat that evening: “Younger generations are more inclined to cook what they see on TV or on their phones. Here you can buy ingredients to cook any cuisine you want: Indian, Jamaican, Thai…”

For Stuart Lewis, the manager of a corner shop in Bournemouth, their USP is their customer service: “Our regular customers always come in and say hi. That two-minute chat can make a big difference to their lives. Some people come in and say ‘Oh, is there any chance you can get this in for me?’. We do everything we can. We’re here to help. We’re here to support the community.”