Keen to dip your toe in the convenience store sector? You’re in good company. There are 50,387 convenience stores across mainland UK, according to ACS’ latest Local Shop Report. Collectively, they generate a whopping £55.9bn in revenue.

But, as the famous adage goes, “revenue is vanity, profit is sanity”. So, how much can convenience store owners expect to pocket at the end of the day?

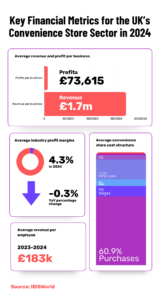

Key financial metrics for the UK’s convenience store sector in 2024

In 2024, the UK’s convenience store sector remains a lucrative opportunity, with the average store bringing in £1.7 million in revenue and £73,615 in profits, according to IBISWorld.

Industry profit margins currently stand at 4.3%, reflecting a modest 0.3% decline from the previous year. Over the past decade, margins have fallen by 1.3%, dropping from 5.6% in 2014 to their current level.

Each employee contributes an average of £183,000 in revenue.

When it comes to costs, 60.9% goes toward purchases, 9% to wages, and 17.5% to other expenses.

Take note, however: these figures may be skewed upward by multiples (e.g. Tesco Express), co-operatives, and symbol and franchise stores like Best-one and Bargain Booze, due to their brand names and buying power.

Symbol stores, for example, benefit from significant perks, such as a dedicated Business Development Manager, experts’ advice and insights, managed EPOS solutions, partnerships with online delivery partners, and significant buying power.

Unaffiliated independents (which account for 38% of all c-stores in the UK) may find their revenues and margins slightly lower than these benchmarks.

Other factors affecting convenience store profits

Shopfloor space

As well as c-store type, revenues and profits will also be determined by factors such as shopfloor space. Larger shopfloors will drive stores’ high-volume, low-margin strategy, but may also come with higher overheads, eating into their bottom line. Small shopfloors won’t generate the same daily revenues but may have healthier margins.

Location

A convenience store’s location is one of the most critical factors affecting its profitability. Stores located near high-traffic areas—such as busy streets, transportation hubs, or densely populated residential areas—tend to generate higher revenues due to constant footfall.

Supplier relationships and pricing strategy

Stores that negotiate bulk discounts or special deals can maintain competitive pricing while protecting margins. Indeed, this may be one of the key attractions of becoming affiliated with a symbol or franchise group.

Additionally, adopting a “surge” or “dynamic” pricing strategy (hello electronic shelf labels) can further enhance profitability.

Wages

Recent annual increases in the National Minimum Wage have put pressure on convenience stores’ bottom lines, reducing their overall profitability.

Fortunately, there’s a partial solution: the growth of in-store technologies, like self-checkouts, has significantly reduced the demand for traditional employee roles such as cashiers and shelf-stockers.

Flexibility in adapting to consumer preferences

Adapting to shifting consumer preferences will be crucial for new entrants’ success in driving revenue and profits. Catering to the growing demand for healthier food options (think protein shakes and low-cal snacks) and offering Uber Eats and Deliveroo integration will serve as key differentiators to drive revenue and profits.

Similarly, as the tobacco product segment shrinks with declining smoking rates, c-stores may wish to expand their vape and vape juice flavour range.

Stocking TikTok-popular products, such as Prime Hydration Drinks, Takis, limited edition Oreo Cookies and Ben & Jerry’s, and vegan-friendly Candy Kittens, may help to drive footfall from younger customers.