The corner shop is often the beating heart of a local area. Opening up a convenience store is often one of the most profitable ventures you can get involved in. Like any business, you must have the funding to make it happen.

With Brexit and the pandemic long gone, the UK’s business community is thriving, with two in five UK SMEs seeking external financing in the three years leading up to 2022. But where do you get financing from, and how can you actually apply for it?

What is convenience store financing?

Convenience store financing is a term used for loans for people who want to open a new convenience store or take over an existing one. With the average cost of setting up a business in the UK now at £22,756, most first-time entrepreneurs take out a loan to help them get started.

This type of financing can take various forms, including bank loans, government grants, or even crowdfunding. Some entrepreneurs use a single type of financing, whereas others choose to mix and match.

Which types of funding are best for a convenience store?

The right type of funding for your convenience store largely depends on what you want to do, the convenience store, and your own finances. Examples of funding you can take advantage of include:

- Startup loans

- Commercial mortgages

- Development loans

- Business loans

- Merchant cash advances

Note that although government funding might be available to open a corner shop, these grants and loans are notoriously difficult to secure and come with strict guidelines attached. In most cases, it’s best to approach a private lender.

Find your New Convenience Store Now

What types of convenience store loans are available in the UK?

The UK enjoys an advanced lending market, meaning you’re sure to find lending options that meet your goals. Whether you’re looking for unsecured loans or you’re willing to give away some collateral, there are plenty of loans available.

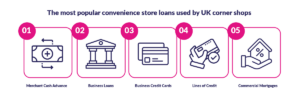

Here are some of the most popular convenience store loans used by the UK’s army of corner shops:

- Merchant Cash Advance – Borrow against future card sales and repay a percentage every month. How much you pay monthly depends on how much revenue you take from cards.

- Business Loans – Business loans provide substantial amounts and may or may not be secured against an asset. These loans are ideal if you want a substantial lump sum with no strings attached on how you can spend it.

- Business Credit Cards – Shop owners who need help covering those smaller expenses can take out a business credit card and access money as and when needed.

- Lines of Credit – Revolving lines of credit allow you to borrow, repay, and borrow again when necessary. They’re often cheaper than traditional loans, but their fees are higher.

- Commercial Mortgages – If you’re looking to buy a building for your store, you’ll have to take out a commercial mortgage. They work just like ordinary residential mortgages, but they’re designed for business purposes.

Common uses of funding and loans for a convenience store

Business loans can be used for practically any expenses that might crop up when opening and running your store. Initially, you can use loans to purchase properties/businesses/franchises, purchase your first wave of stock, buy card machines, and promote your grand opening.

During the course of running your business, you might take out loans to purchase more stock, add new services to your store, or fund expansions and all the associated costs that come with that.

In short, there’s nothing you can’t use your funding for to give your convenience store the best possible chance of success.

Eligibility for convenience store financing

Are you eligible for convenience store finance in the UK? The answer to this depends on the type of loan you’re applying for and any criteria set down by the lender. Luckily, the eligibility requirements are pretty straightforward.

You’ll need to be registered in the UK, be over 18, and have been trading for at least three to six months. Beyond that, issues like your credit score and financial projections will come into play.

It’s also important to mention that some products may come with extra criteria. Here are some examples:

- Secured Loans – A high-value asset to secure the loan against.

- Unsecured Loans – Annual turnover requirements are often around £10,000 to qualify for these loans.

- Merchant Cash Advances – You’ll need to process a minimum amount in card sales every month. Generally, you should be taking at least £2,500 in monthly card sales to qualify.

Lenders might also want to look into your trading history and industry experience. However, just because one lender rejects your application doesn’t mean you’re ineligible for corner shop financing.

Chat to us About your New Convenience Store Plan

How to get funding for a convenience store

Applying for a convenience store loan can be done entirely online these days. It’s usually a matter of:

- Comparing lenders online.

- Filling out an online application form, complete with required documentation.

- Waiting for an answer from the lender.

Gone are the days of scheduling a meeting with your local banker and then waiting weeks to see if they’ll approve your loan. However, you still might run into issues. Incomplete applications and insufficient documentation are still the most common reasons your application might not go through.

Get prepared before you even apply with all the documentation you need. Your lender might want to see:

- Proof of identity.

- Proof of address.

- Your last three months of bank statements.

- Cashflow forecast.

- Your formal business plan.

Having these documents in your pocket immediately enables you to apply with ease and avoid seeing your application delayed. Depending on the lender, it’s entirely possible that some financing options could be available for you to use in your shop in a matter of days.

However, before applying for financing, you need the perfect convenience store for you. At Cogogo, we support UK entrepreneurs in sourcing ideal corner shops for their next business ventures. To learn more about buying a new business or selling an existing one, contact the team today.